Nerida Conisbee

Ray White

Chief Economist

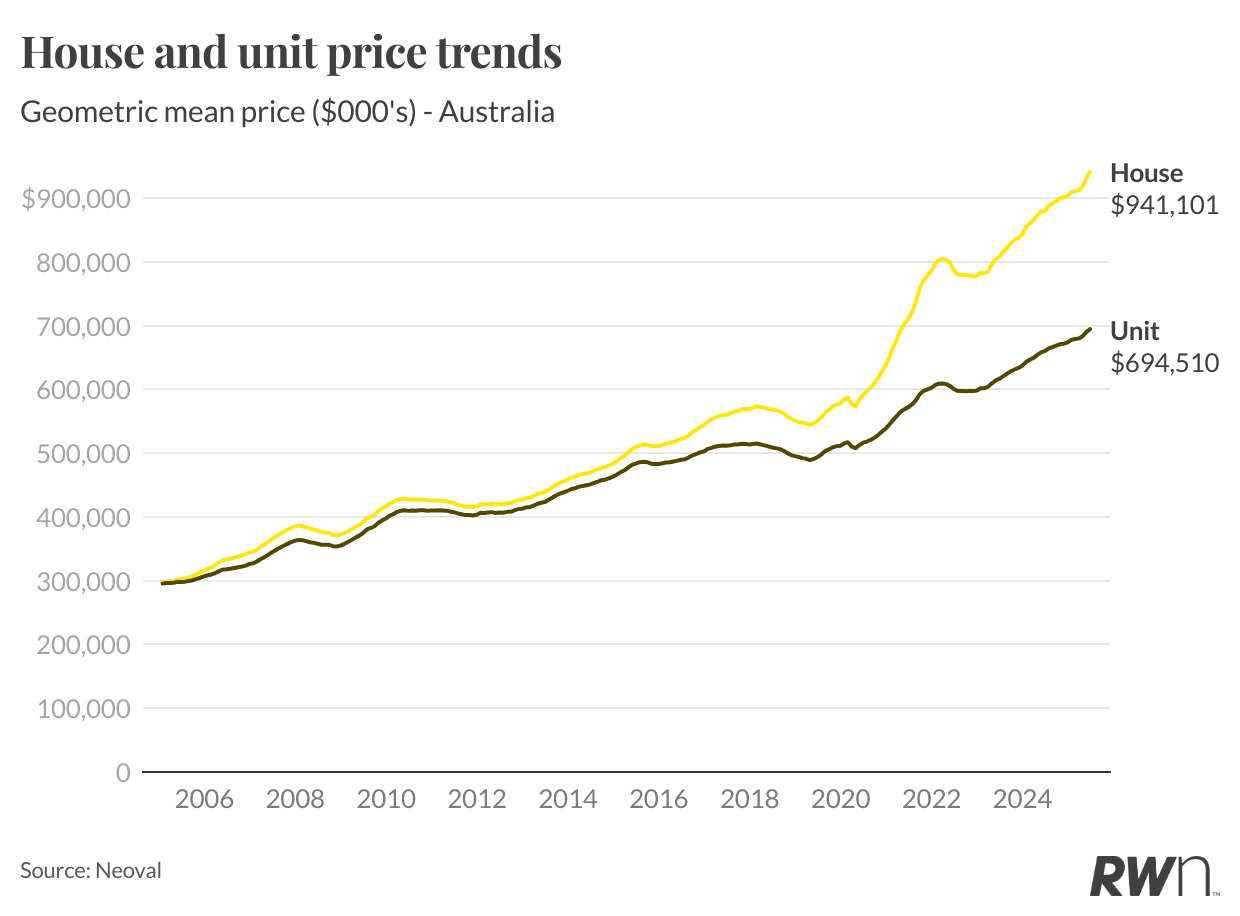

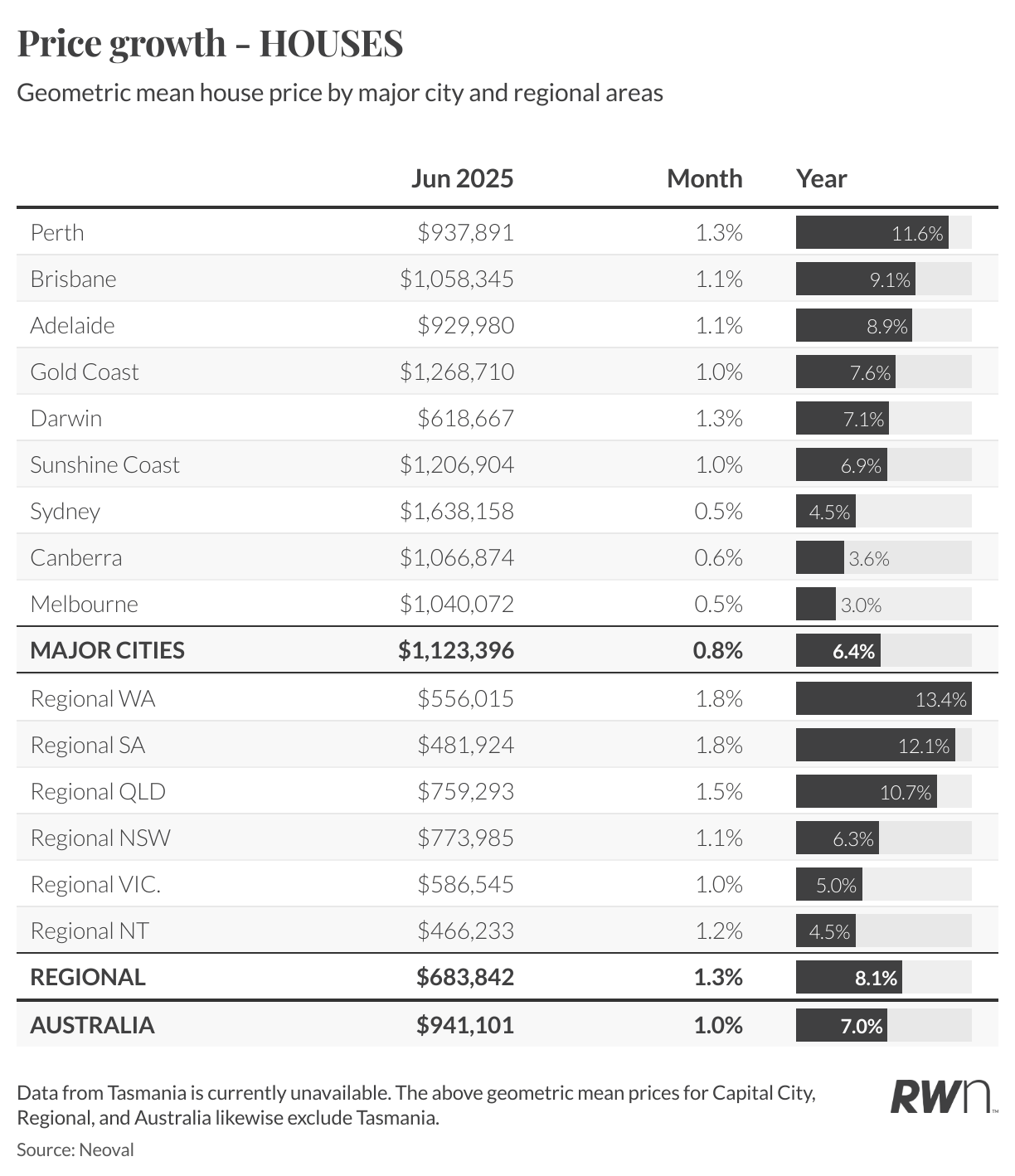

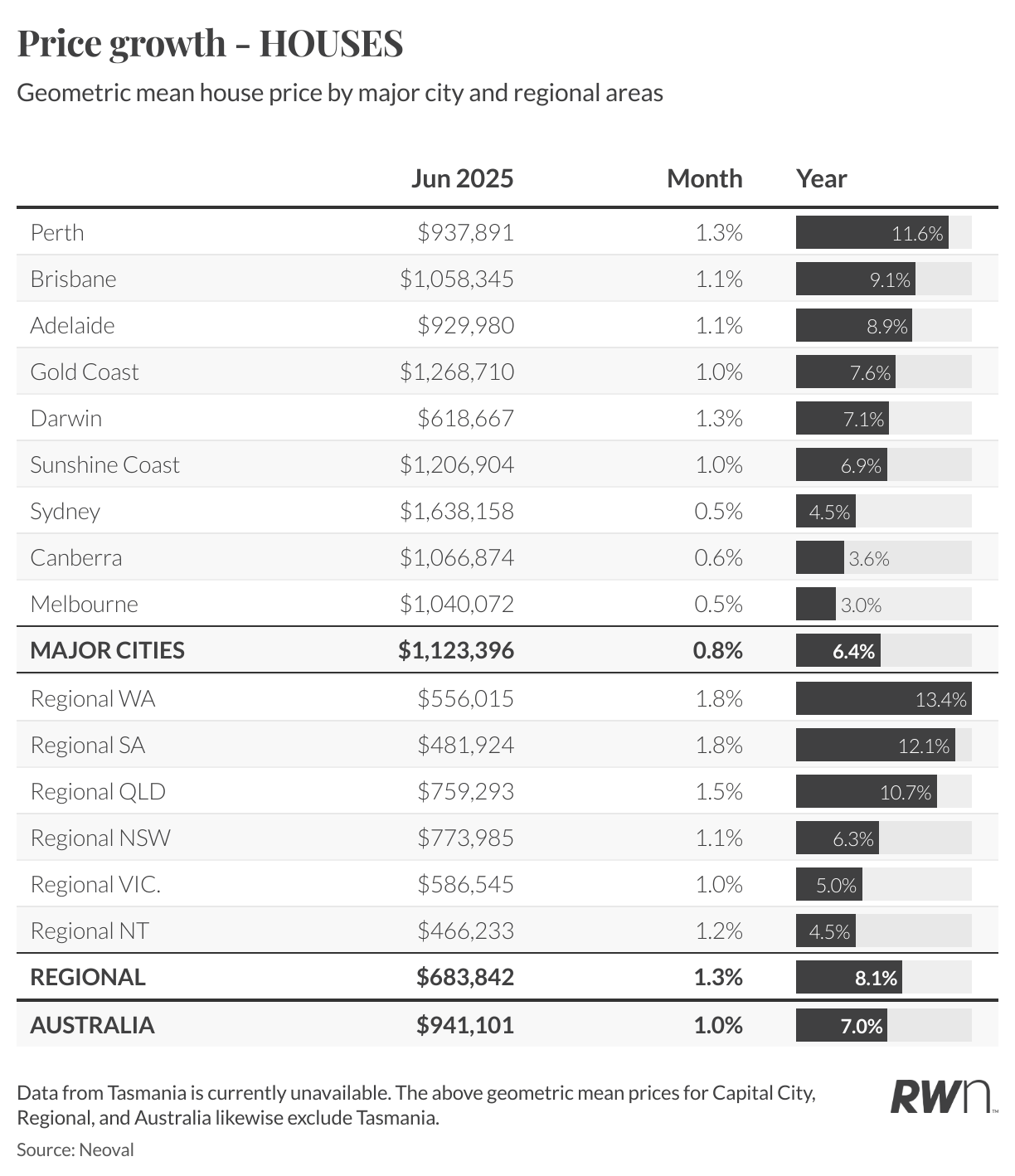

Australia’s housing market is now in a coordinated acceleration phase, with every single major market now exhibiting monthly growth rates that signal significant momentum building across the nation. Perth’s 1.3 per cent monthly growth, if sustained, would deliver annual returns well above its current 11.6 per cent annual rate. Similarly, Darwin’s 1.3 per cent monthly pace suggests the market is running considerably hotter than its 7.1 per cent annual figure indicates, whilst even slower markets like Melbourne and Sydney are showing renewed vigour with 0.5 per cent monthly growth that exceeds what their recent annual growth rates of 3.0 per cent and 4.5 per cent respectively might suggest.

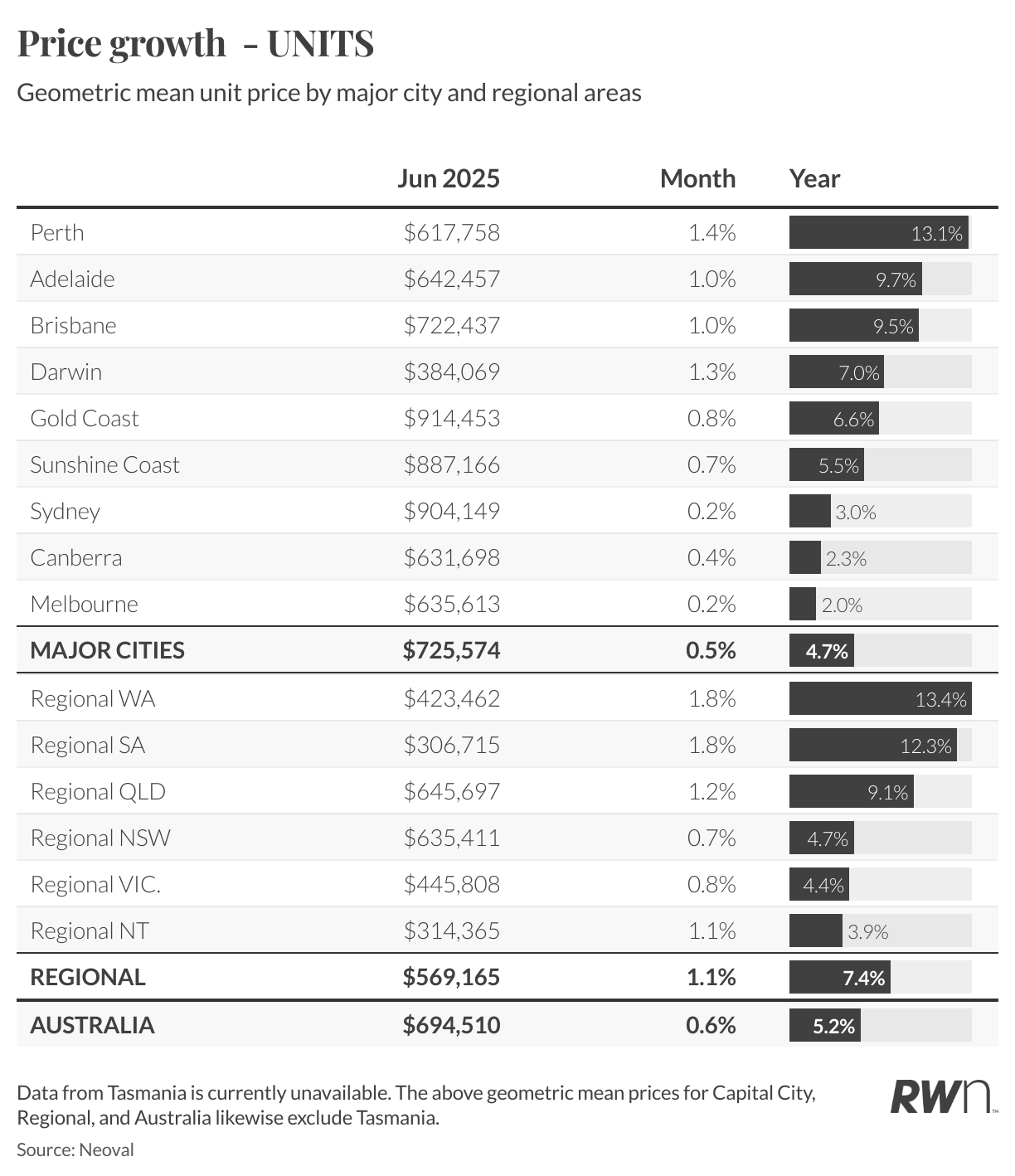

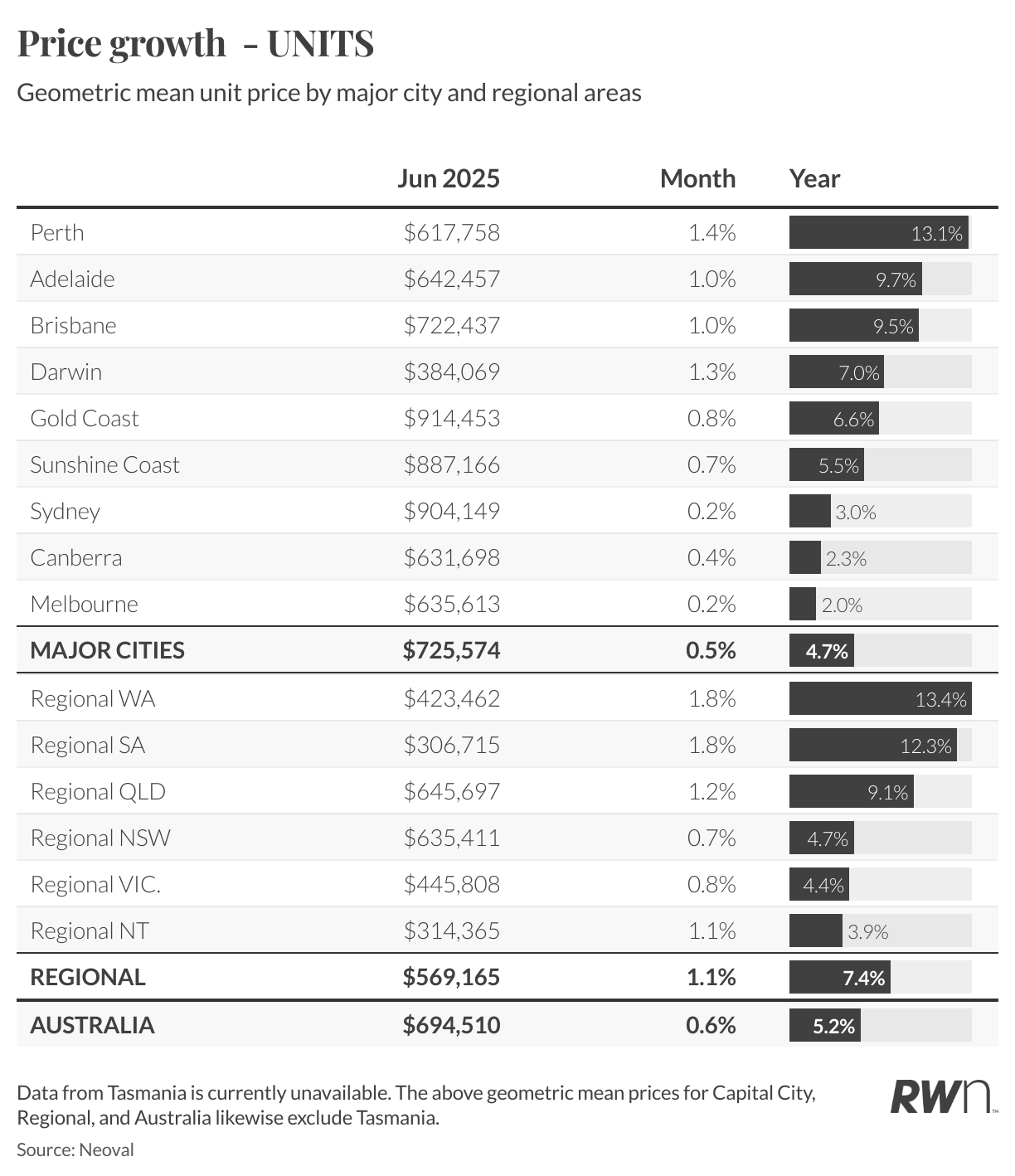

The unit market tells the same story, with Perth units leading the charge at 1.4 per cent monthly growth, significantly outpacing their 13.1 per cent annual rate, whilst Adelaide and Brisbane units both maintain solid 1.0 per cent monthly momentum. Even regional unit markets are participating in this synchronised surge, with Regional WA and Regional SA both recording exceptional 1.8 per cent monthly growth rates.

This acceleration appears to be directly driven by the Reserve Bank’s interest rate cutting cycle, with two cuts already delivered this year and three more anticipated before year’s end. If current monthly growth rates continue nationally, Australia could be looking at annual house price growth of around 12.7 per cent by mid-2026, nearly double the current 7.0 per cent annual rate, while unit growth could accelerate from 5.2 per cent to 7.4 per cent annually. Such acceleration would push the national median house price from $941,000 to over $1.06 million within 12 months, representing a $119,000 increase, while the unit median would rise from $695,000 to $746,000, an increase of around $52,000. With further rate cuts expected to provide additional stimulus, this coordinated acceleration phase may well strengthen further.